Optimizing organic grain prices is critical for long-term profitability

The long-term success of your family farm depends on selling your crops. The goal, of course, is to lock in organic grain prices that capture as much upside as possible. And at the same time minimize the risk you’re taking on.

That’s much easier said than done! But you can start by getting familiar with the organic commodities market. In particular, we suggest closely following organic corn prices and organic soybean prices along with other crops key to your farm’s bottom line.

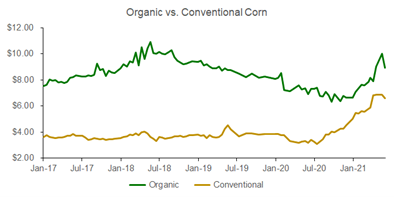

You’ll also want to have a sense of how the market moves over time. The chart below illustrates how much organic grain prices have changed up and down over the last decade.

The organic market marches to the beat of its own drummer

If you understand how to sell your grain in the conventional market, don’t be fooled into thinking you understand the organic market. They are not the same.

Organic grain prices don’t operate in the same ways as conventional prices, and the two markets aren’t nearly as correlated as you’d expect them to be. To realize the highest organic grain prices for your crops, you must pay attention to:

Supply and demand. As you probably know, there’s no futures market for organic crops. That means financial players aren’t involved, and organic farmers don’t have the ability to hedge using futures or options. As such, the organic grain market is driven by supply and demand outlooks. This can be difficult to navigate since the amount of information available is not as readily available as it is in the conventional markets.

Imported organic grain, feed, and meal. Demand for organic corn and soybeans far exceeds the available supply in the U.S. As a result, organic products imported from foreign countries can have a big impact on U.S. grown organic corn prices and organic soybean prices. However, it’s an ever-changing landscape. Sometimes, this is due to tariffs that make imports more or less attractive to end users. Other times it involves international shipping rates or changes to policy about how one country recognizes another country’s organic program (organic equivalency).

Price movements. While prices can spike and fall quickly in the conventional markets, changes in organic grain prices tend to happen much more slowly. Without a futures market and with less market transparency, price discovery simply takes longer in the organic sector. Price shifts can also be drastically affected by the local markets’ commercial storage and grain availability.

Resources to help you track organic grain prices

The organic grain marketplace is much less transparent than its conventional counterpart. But there are some reputable resources that you can access for organic grain prices, volumes, moving averages, and more:

National Organic Grain and Feedstuffs Report. This commodities report is provided free of charge by the USDA.

Mercaris. This fee-based service delivers organic grain prices data to help farmers make better decisions.